Investing With The Crowd

There is a small group of investors, classified as ‘sophisticated’ or ‘wholesale’ investors who chose to invest “with the crowd”.

These sophisticated investors represented just 1.5% of the number of people that invested in equity crowdfunding, but their investments totalled 33.5% of the the total invested. Or in figures: Crowdfunding saw 14788 people invest $26.3million collectively between July 1st 2018 – June 30th 2019. Of that just 211 people, invested a total $8.8 million.

The options to invest as “sophisticated investors” are more numerous than those on offer to “retail” or “mum and dad” investors.

Yet, they chose to “invest with the crowd” instead of putting their money in property (Australia’s favourite) or private equity deals (which carry loads of social cache) or wherever they want.

In their calculations, they determined that the venture seeking equity crowdfunding must be good, and the venture must be improved with crowd participation – and that their money was best spent “investing with the crowd”.

Why These Investors Are Savvy

These investors are to be credited for their savvy.

Investing with the crowd makes sense.

- It de-risks the underlying venture if key stakeholders – employees, customers, suppliers, friends and family – can have an actual stake and support the venture.

- It adds a free layer of due diligence. Investors no matter how smart can’t afford the due diligence costs to go back through history and trawl the backgrounds of key personnel and investigate competitive landscape as well as a crowd of retail investors can.

- It creates a hive mind. The most successful raises provide constant attendance to their crowd through the investment process in a transparent way enabled by the platforms. This allows 3 critical things 1) any would-be investor can see the concerns/questions of others who have invested / intend to invest, 2) all can see the answers provided by the company to those concerns / questions and 3) can see the assessment of others to those answers.

- An “opportunity escalation effect” is created in the forums, during a raise, if/when an investor / would be investor has an insight, introduction, opportunity or even just gives a voice to their support, it can resonate and get others activated for the benefit of the venture. This escalates, unearths and opens up new opportunities for revenue.

Swimming Against The Tide

Australia is a small place.

The startup scene is even smaller.

A concentrated effort by Angel groups, VC’s and some sections of the media told the Australian community crowdfunding was for losers. (Read previous blog: There Are So Many Losers In Crowd Funding).

The sophisticated investors who “invested with the crowd” and who had other options that retail investors don’t have, made up their own mind about risk and reward. They chose to back the ventures that got the backing of their crowd and gave their stakeholders an actual stake (and not just lip-service).

Swinging Around To Impact

It has always been our view at Ethical Fields that Equity Crowd Funding isn’t about startups, tech-companies or getting on the ground floor of a unicorn. (See Blog: Crowdfunding Winners)

We think this early focus by the industry on startups is misguided and focuses on the “funding part of crowdfunding” and the really interesting part is the “crowd part of crowdfunding”.

The most successful raises like Shebah ($3m) and Food Connect ($2.1) were successful because they facilitated something a crowd of people deemed important. Respectively, Shebah with women travelling safely with ride-sharing and Food Connect establishing a fair food system.

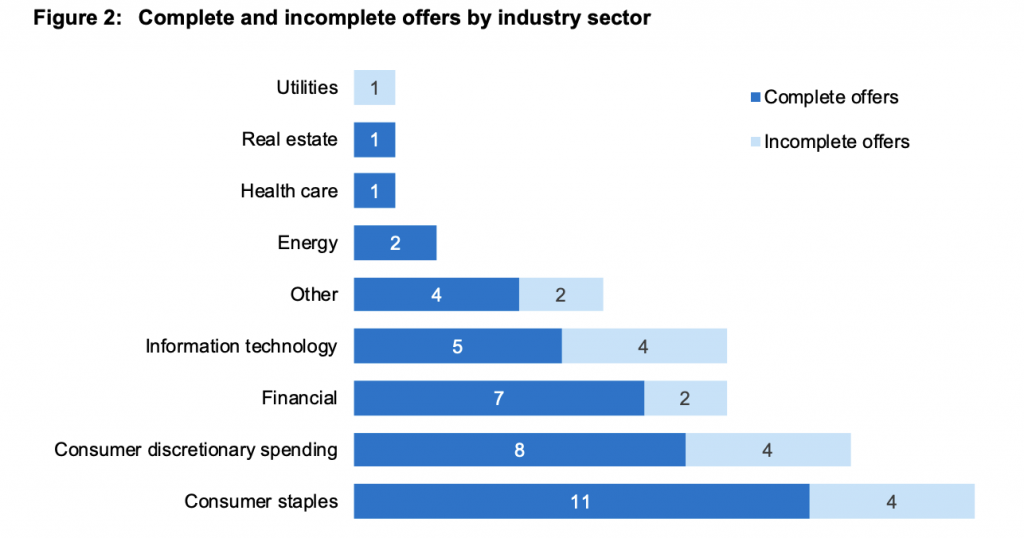

Most of the early raises have been for consumer products and consumer discretionary spend products, but with COVID-19 putting communities under pressure, our prediction is that we will start to see communities pooling together for essential and impactful resources they share locally such as Energy, Food, Water, Waste, Education and Social Services.

These will continue to find success from the retail investors. Encouragingly they may also be where we savvy sophisticated investors are also putting their money to work.

Modelling The Equity-Crowd-Funding-Local-Impact-Investor

Communities and businesses seeking to establish in these local conditions and using Equity Crowd Funding in the process should be seeking experience from the raises we’ve seen so far. The questions they need to ask include:

- Who is the 1 in 65 investors in my crowd that can put in bigger funding amounts?

- What drives them to invest?

- How can I communicate the benefits my crowd brings to the ventures raise and in doing so demonstrate this reduces their risk / increases the chances of reward?

- How can I support them to talk / share with their friends (birds of a feather flock together) so we get more of these big-impact investors?

- When should we engage with them? What’s the plan? How?

If you or your venture needs help with this sort of thing then get Ethical Fields to help.